What is the district’s financial situation?

The district receives money for students from the state and federal governments and from local sources. Passage of Proposition 30 in November 2012 significantly improved the financial health of Davis schools and public schools throughout California.

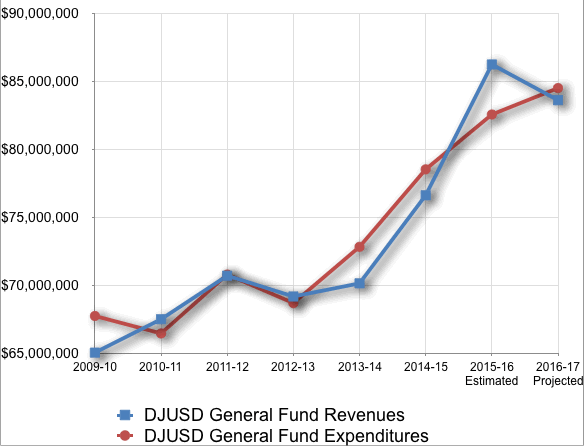

If the district regularly spends more money on ongoing expenses than it receives, the budget has a structural deficit. If deficit spending continues, the district may not be able to pay all its bills in the future.

In recent the years, the district has had a structural deficit, using reserves and one-time funding to avoid program cuts. With new funding from the state, this trend has been reversed.

If the Board does not act to keep the district financially secure, the state can assume control of the district and make necessary reductions.

How does California’s investment in public education compare with that of other states? (EdSource)

How do we pay for California schools?

How much money does the district receive?

How much money does the district receive?

Move your mouse pointer over areas of the chart to see detailed descriptions of each item.

Projected DJUSD Revenues for 2016-17

(As of July, 2016)

| $ Amount | % of Total | Fund Description | ||

|---|---|---|---|---|

| General Fund | This is the chief operating fund, accounting for the ordinary operations of the school district. All transactions except those required or permitted by law to be in another fund are accounted for in this fund. | |||

| Local Control Funding Formula (LCFF) | $61,914,357 | Allocated to the school district based upon the number of students and the amount of time each spends in school. | ||

| Other State Revenue | $5,860,743 | Allocated to the district to provide special services for students. State lottery funds as well as other State restricted categorical programs are included in this category. | ||

| Local Revenue | $13,335,122 | Education funding from the community through voter approved parcel taxes, donations and miscellaneous sources. Includes State special education funds that are passed through the Yolo County Office of Education. | ||

| Federal Revenue | $2,496,270 | Allocated to districts to provide special services for students | ||

| Subtotal General Fund | $83,606,492 | 90.6% | ||

| Other Funds | ||||

| Charter Schools | $4,894,621 | 5.3% | Accounts for the activities of the DaVinci Charter Academy not reported in the General Fund that are reported in the Charter Schools Fund. | |

| Adult Education | $610,623 | 0.7% | Accounts for federal, state, and local revenues for adult education programs. | |

| Child Development | $336,203 | 0.4% | Accounts for federal, state, and local revenues to operate child development programs. | |

| Cafeteria | $2,176,654 | 2.4% | Accounts for federal, state, and local resources to operate the food service program. | |

| Capital Facilities | $612,000 | 0.7% | Accounts for fees levied on developers as a condition of approving a development and City of Davis redevelopment funds. | |

| Special Reserve Fund for Capital Outlay Projects | $10,000 | 0.0% | Accounts for the revenues received from the sale of surplus property (Grande). | |

| Building Funds | $40,000 | 0.0% | Accounts primarily for proceeds from the sale of bonds and may not be used for purposes other than those for which the bonds were issued. | |

| Self Insurance | $850 | 0.0% | Accounts separately for moneys received for self-insurance activities such as health and welfare, and deductible property loss. | |

| Foundation Trust Fund | $3,245 | 0.0% | Accounts for local donation funded student scholarships. | |

| Total All Funds | $92,290,688 | 100% |

Would you like to see the complete DJUSD Adopted Budget Report

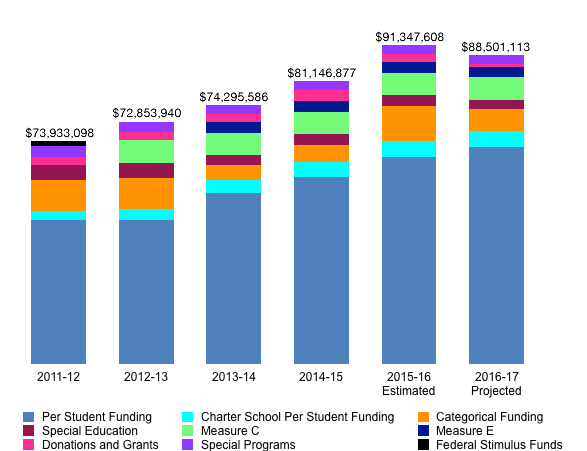

How does district revenue change by year?

Move your mouse pointer over areas of the chart to see detailed descriptions of each item.

Please note that smaller funding sources are not included in the bar chart. The table below contains them.

Move your mouse pointer over areas of the chart to see detailed descriptions of each item.

Please note that smaller funding sources are not included in the bar chart. The table below contains them.

District General Fund and Charter School Revenue

(As of July, 2016)

| 2011-12 | 2012-13 | 2013-14 | 2014-15 | 2015-16 (Estimated) | 2016-17 (Projected) | Descriptions | |||

|---|---|---|---|---|---|---|---|---|---|

| State Revenue | Funding provided by the state of California | ||||||||

| COLA (Unfunded) | $4,882,350 | $6,369,001 | Cost of Living Adjustment (COLA): In good economic years, the state provides an increase in prior year funding so that districts can meet routine cost increases. In poor economic years, COLA is reduced or unfunded. | ||||||

| Deficit/LCFF Funding GAP | $5,613,104 | $5,254,269 | $14,557,729 | $10,562,502 | $5,274,256 | $2,338,286 | Funding owed to the district by the state, but not paid | ||

| Per Student Funding | $41,123,481 | $41,146,951 | $48,757,875 | $53,563,456 | $59,172,312 | $61,914,357 | Ongoing money allocated to the school district based upon the number of students and the amount of time each spends in school. The district receives the same amount of per pupil funding for students, whether they are attending the general education program or a magnet (e.g. GATE, Spanish Immersion, Montessori) program. | ||

| Charter School Per Student Funding | $2,753,378 | $3,186,178 | $3,838,419 | $4,142,797 | $4,367,562 | $4,540,652 | Ongoing money allocated to DaVinci Academy based upon the number of students and the amount of time each spends in school. | ||

| Categorical Funding | $8,353,262 | $8,384,798 | $3,891,886 | $4,592,308 | $9,371,542 | $5,860,743 | Ongoing money allocated to the district to provide special programs for students. The state has granted temporary flexibility to reallocate previously restricted funds for general operating expenses | ||

| Charter School Categorical Funding | $323,924 | $399,837 | $271,271 | $254,871 | $679,274 | $344,177 | Ongoing money allocated to the DaVinci Charter School to provide special programs for students. | ||

| Special Education | $4,387,698 | $4,401,489 | $2,829,560 | $2,992,033 | $3,047,577 | $2,689,632 | Ongoing funds to provide services to students with special needs. These are state funds passed through to the Special Education Local Plan Area (SELPA) and on to the district. | ||

| Local Revenue | Funding coming from sources within Davis | ||||||||

| Measure C | $6,350,910 | $6,461,854 | $6,432,709 | $6,434,240 | $6,434,240 | Local parcel tax ($327/parcel) that replaced Measure Q & W and supplements school funding from July 1, 2012 to June 30, 2016. | |||

| Measure E | $3,080,479 | $3,079,728 | $3,074,484 | $3,074,484 | Local parcel tax renewal ($204/parcel) intended to backfill state funding reductions from July 1, 2013 to June 30, 2016. | ||||

| Donations and Grants | $2,252,194 | $2,355,811 | $2,051,144 | $2,867,241 | $2,123,928 | $773,766 | One-time community contributions including a $1.5 million grant from the Davis Schools Foundation in 2008-09 | ||

| Other Local Revenue | $533,71 | $444,531 | $375,435 | $367,229 | $373,112 | $363,000 | Miscellaneous revenue from local sources | ||

| Charter School Donations and Grants | $67,717 | $103,034 | $54,426 | $140,815 | $69,594 | $9,792 | Donations and miscellaneous local funds for DaVinci Academy | ||

| Federal Revenue | Funding provided by the United States government | ||||||||

| Special Programs | $2,961,721 | $2,887,161 | $2,683,237 | $2,713,690 | $2,633,983 | $2,496,270 | Ongoing restricted money allocated to districts to provide specified services for students including special education programs | ||

| Federal Stimulus Funds | $1,536,470 | $0 | $0 | $0 | $0 | One-time money received under the American Recovery and Reinvestment Act & Jobs Bill | |||

| Charter School Special Programs | $92,430 | $0 | $0 | $0 | $0 | One-time restricted money allocated to DaVinci Charter to provide specified services | |||

| Totals | |||||||||

| Total Funded Revenue | $73,933,098 | $72,853,940 | $74,295,586 | $81,146,877 | $91,347,608 | $88,501,113 | |||

| General Fund | $70,695,649 | $69,164,891 | $70,131,470 | $76,608,394 | $86,231,178 | $83,606,492 | |||

| Charter School Fund | $3,237,449 | $3,689,049 | $4,164,116 | $4,538,483 | $5,116,430 | $4,894,621 | |||

| Breakdowns | |||||||||

| Number of Students (adjusted for average daily attendance) | 8,285 | 8,290 | 8,253 | 8,247 | 8,205 | 8,197 | |||

| Per Pupil Funding | $8,924 | $8,789 | $9,002 | $9,840 | $11,133 | $10,797 |

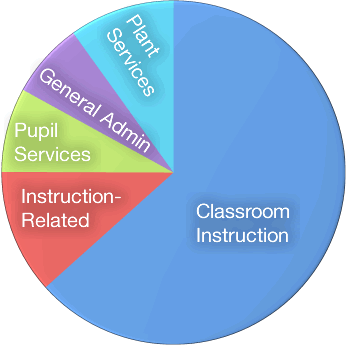

How much money does the district spend?

Projected DJUSD Expenditures for 2016-17 by Function

(As of July, 2016)

| $ Amount | % of Total | Fund Description | ||

| General Fund | This is the chief operating fund, accounting for the ordinary operations of the school district. All transactions except those required or permitted by law to be in another fund are accounted for in this fund. | |||

| Classroom Instruction | $52,487,141 | 62% | Teachers, para-educators, instructional supplies and services | |

| Instruction-related Services | $9,685,885 | 11% | Supervision of instruction/assessment, library services, teacher staff development, and summer school | |

| Pupil Services | $6,574,583 | 8% | Counseling and college planning; psychology and individual learning assessments; nurses for screening and health education; school climate; student behavior, attendance, suspensions and expulsions; complaints and investigations; safety and emergency preparedness; grief and crisis counseling | |

| General Administration | $5,872,279 | 7% | Education oversight, human resources, budget and payroll, student attendance reporting; legal services and elections; technology and community relations | |

| Plant Services | $8,217,513 | 10% | Utilities; custodial; landscape, irrigation, and field maintenance; campus safety and security; telecommunications | |

| Ancillary Services & Community | $903,594 | 1% | Miscellaneous services includes Athletics programs & Facilities Use | |

| Other Outgo | $753,310 | 1% | Miscellaneous expenditures including debt service for leases & Special Education program fees for other local educational agencies | |

| Subtotal General Fund | $84,494,305 | 80.7% | ||

| Other Funds | ||||

| Charter Schools | $5,148,933 | 4.9% | DaVinci Charter Academy expenses | |

| Adult Education | $514,138 | 0.5% | Adult education program expenses | |

| Child Development | $379,641 | 0.4% | Expenses for operating child development programs | |

| Cafeteria | $2,247,454 | 2.1% | Expenses for operating the food service program | |

| Capital Facilities | $702,588 | 0.7% | Expensed funds from fees levied on developers or other agencies as a condition of approving a development | |

| Special Reserve Fund for Capital Outlay Projects | $1,025,000 | 1.0% | Expensed funds from the sale of surplus property (Grande) | |

| Building Funds | $10,115,810 | 9.7% | Expensed funds from proceeds of the sale of bonds and may not be used for any purposes other than those for which the bonds were issued. | |

| Self Insurance | $15,000 | 0.0% | Expenses for self-insurance activities such as health and welfare, and deductible property & liability losses. | |

| Foundation Trust Fund | $3,000 | 0.0% | Expended funds for local donation funded student scholarships | |

| Total All Funds | $104,645,869 | 100% |

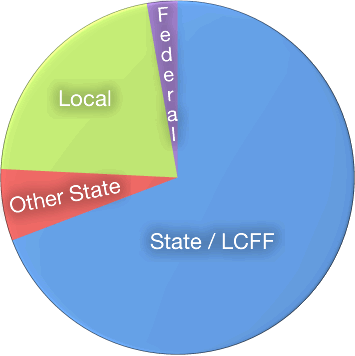

How do we pay for California Schools?

About 85% of the money for California schools comes from the state. The rest comes from the federal government and local sources.

Our state amount is based on the number of students in the district and how much time each student spends in school. It also depends on Proposition 98 and the Local Control Funding Formula.

What is the Local Control Funding Formula?

California school finance changed dramatically with the passage of the state budget in July 2013. Beginning with the 2013-14 school year, school districts and charter schools receive funding under the Local Control Funding Formula (LCFF) with two goals: to improve outcomes for students and to allow more decisions to be made locally about how dollars are spent to achieve better results.

Each district now receives a “base grant” for every student. The majority of California’s education dollars will fund base grants.

Source: EdSource.org

In addition to base grants, districts receive a “supplemental grant” of 20% of the base for every high needs student. These include students who come from low-income families, those learning English and those living in foster care. Districts with more than 55% high needs students will also receive a “concentration grant” for the number of students over that threshold.

27% of students in the Davis Joint Unified School District qualify as high needs. The district will receive a supplemental grant based upon this percentage, but does not qualify for a concentration grant.

Davis received $6,333 for each student in 2013-14. That amount is expected to grow to $9,463 in 2020-21 when the state plans to fully implement the Local Control Funding Formula.

Would you like to see how our district funding compares to other districts? (EdSource)

Under the LCFF, districts prepare a Local Control and Accountability Plan that describes how education dollars are spent to address state priorities:

- Conditions of learning, including access to core services, implementation of state standards and course access.

- Pupil outcomes, including, student achievement and other student outcomes.

- Engagement, including parent involvement, student engagement and school climate.

Source: EdSource.org

The district prepared its first Local Control and Accountability Plan in 2014 and continues to engage stakeholders in creation, annual review and approval. A public hearing is held in June prior to final approval of the plan. The district then submits the plan to the Yolo County Office of Education for review.

Would you like to learn more about the district’s Local Control and Accountability Plan? (DJUSD)

What is Proposition 98?

California voters passed Proposition 98 in 1988 and again in 1990 to guarantee a minimum level of funding for K-14 public education. This level depends on the state’s economy. When the economy does well, schools get more money. In poor economic years, schools get less.

Would you like to learn more about Proposition 98? (Legislative Analyst's Office, Video)

How have recent state budgets affected Davis public schools?

Recent state budget decisions have caused the state to:

- Increase the amount of money sent to schools. With the passage of Proposition 30 in 2012, the state began to restore funding to schools in 2013-14. Districts receive these dollars under the new Local Control Funding Formula.

- Eliminate deferred state funding. During the budget crisis, districts received funding a year late from the state. These deferred payments grew to nearly $10 billion statewide, but have now been fully repaid to schools.

What is Proposition 30?

Proposition 30 was placed on the November 6, 2012 ballot by Governor Jerry Brown. It's purpose was to prevent more reductions to state funding for education.

As approved by the majority of California voters, the measure:

- Increased the sales tax rate by one-quarter cent for every dollar for four years

- Increased personal income tax rates on upper-income taxpayers for seven years

- Will raise about $6 billion in additional annual state revenues through 2016-17, with smaller amounts in 2017-18 and 2018-19.

These additional revenues are available to help balance state budget only through 2018-19. Proposition 55 has been placed on the November 2016 ballot to extend the Proposition 30 income tax rates.

Would you like to learn more about Proposition 30? (BallotPedia article)

Would you like to learn more about Proposition 55? (BallotPedia article)

Would you like to learn more about California school finance?

- The Local Control Funding Formula: An Essential EdSource Guide (EdSource, 2016)

- State Budget Heads to Gov. Brown; How Education Fared (EdSource, 2016)

- Local Control Funding Formula Overview (CA Dept. of Education, 2016)

- Ed-Data: Education Data Partnership (Ed-data, 2016)

- Local Control Funding Formula (WestEd, 2016)

- California School Finance (EdSource, 2016)

Would you like to see a brief history of school finance reform in California? (EdSource, 2014)